21 Abr Intuit Certified Bookkeeping Professional Exam

Content

When you feel you have enough education, you can begin applying for jobs or start your own bookkeeping business. You will need to learn how to start a bookkeeping business in your location, such as how to file for https://adprun.net/quickbooks-vs-quicken-knowing-the-difference/ a license if you choose to have an in-person office. You may be able to get on-the-job training through a bookkeeping job that only requires a high school diploma, such as an internship or training placement.

Is QuickBooks and Intuit the same?

QuickBooks is an accounting software package developed and marketed by Intuit.

However, you will likely need to complete a degree program and other certifications to be an accountant or move beyond a bookkeeping role. Full-Service Bookkeeping doesn’t include sending invoices, paying bills, or management of inventory, accounts receivable, or accounts payable. The service doesn’t include financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll. By selling bookkeeping services right beside a QuickBooks Online subscription, QuickBooks is educating small businesses for us.

Online

These online courses let you feed your curiosity and develop new skills that have real value in the workplace. The role can function as a part-time job to supplement other income, or you can be a full-time bookkeeper. If you become a QuickBooks Live bookkeeper, you can work from home based upon an agreed schedule at a set hourly rate based on your location, interview, and experience level. The Certified Bookkeeper (CB) program from the AIPB requires you to be a working bookkeeper or have at least one year of accounting education. The program includes self-teaching workbooks that prepare you to pass the CB exam. Someformal certifications include the National Association of Certified Public Bookkeepers (NACPB) and the American Institute of Professional Bookkeepers (AIPB).

If prospects go first to Intuit for the bookkeeping, there’s a good chance they’ll never walk in the door of that accounting firm. While traditional bookkeeping is all about recording financial transactions, accounting is about interpreting, classifying, analyzing, reporting, and summarizing financial data. That’s why bookkeepers had better retrain and learn to manage the machines. By mastering cloud accounting technology and getting my CPA, I turned myself from a bookkeeper into what I like to call an “accounting technologist.” It’s a rare set of skills that allows me to write my own ticket. Even if Intuit hires thousands or tens of thousands of bookkeepers, it will be only a fraction of the current jobs.

Intuit Bookkeeping Certificate Online

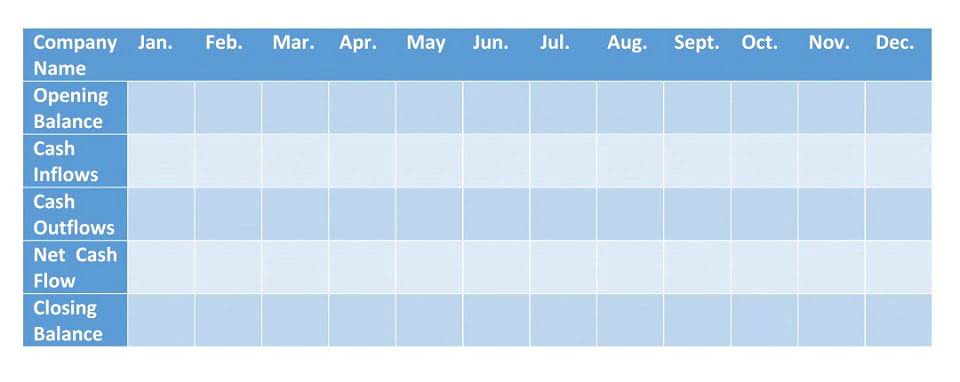

This module covers the basics of bookkeeping, including the accounting equation, double-entry bookkeeping, and financial statements. By the end of this module, you’ll have a solid foundation in the fundamentals of bookkeeping. Intuit is working with a council of accounting professionals for guidance on QuickBooks Live, including the qualifications required to participate.

- While most bookkeepers work with businesses, some individuals may also choose to hire a bookkeeper to track personal finances.

- •Certified professionals in the IT industries have an average salary of about $110,000, 8% more than individuals without certification.

- That’s good news for accountants, especially since there’s already a shortage of accounting and finance talent.

- Rich stated that he regrets not communicating Intuit’s test to accounting professionals, especially ProAdvisor program members – in advance of running the test.

- In concert, this is Intuit’s way to engage ProAdvisors – to bridge the talent pool of the professional bookkeeping community to this underserved small business demographic.

To fill that gap and help businesses succeed, we’ll begin testing what we’re calling “QuickBooks Live Assisted Bookkeeping” (Assisted Bookkeeping). This new program offers businesses access to QuickBooks experts who will provide guidance without taking control of their books—someone who will “do it with me,” rather than “do it for me”—at a lower cost. You’ll use Excel, Google Sheets, Numbers or an equivalent spreadsheet program for some of your assignments. Even better, you’ll gain relevant QuickBooks Online experience through hands-on practice labs that let you apply what you learn to real-world accounting scenarios.

Intuit Bookkeeping Certificate Exams

Intuit provides its employees with supplemental learning materials after training has been completed to assist employees in developing their skills. You can work with other bookkeepers and tax experts to share and expand your knowledge. If you’re interested in being a freelance virtual bookkeeper, you can sign up for freelance marketplace websites to connect with potential clients. Freelance jobs can range from quick temporary projects to long-term employment. However, they may be less likely to offer training or educational opportunities. Many programs will provide certificates to show you completed the course.

In week 1, you’ll start with an overview of liabilities, how to account for them, and how to use sales tax payable accounts. The lessons cover everything from preparing for reconciliation to managing balance sheets and using QuickBooks online. There are various insights from professionals, as well as 4 practice exercises and a 1-hour assessment. The comprehensive Bookkeeping certification from Intuit helps students build a foundational knowledge of bookkeeping concepts and crucial accounting measurements. Throughout the four courses, you’ll discover what it takes to work through the various phases of the accounting cycle and how to produce essential financial statements.

Certifications

In the final course of this certificate, you will apply your skills towards financial statement analysis. If you have the foundational concepts of accounting under your belt, you are ready to put them into action in this course. Here, you will learn how to reconcile Charles Kurk Professional Bookkeeping Services different types of accounts, check for accuracy, and troubleshoot errors. Additionally, you will practice how to apply different analytical methods to key financial statements and understand how these methods inform a variety of business decisions.