26 Ene The Pros and Cons of Accounts Payable Outsourcing

Your Account Payable team processes the vendor invoices and can also help you make the payments to your vendors via Bank ACH/Wire. Your Account Payable process is set up so that every invoice that comes in is acted upon the same day. Exception Invoices requiring further action are tracked to ensure quick resolution. Your team takes on the ownership of every invoice from receipt to payment. Use of ARDEM Cloud Platforms bring Technology for further business process improvement. One of the biggest reasons to outsource AP is that it allows companies to scale up their operations without hiring additional staff.

They evaluate your current accounts payable workflows, identify areas for enhancement, and implement best practices to optimize processes, reduce errors, and increase overall efficiency. Many vendors from across the globe offer Accounts Payable services, and businesses that utilize them can save time and money and take loads of stress off their employees. Corcentric’s wide range of product solutions such as accounts payable outsourcing, invoice processing, as well as accounts receivable, makes us an essential part of the success of any company. With a relentless focus on the customer, Corcentric works with businesses to improve cash flow and achieve the operational efficiency they’ve been searching for. Reputable accounts payable outsourcing services provide real-time access to your accounts payable data and transparent reporting. You can view payment status, monitor invoice processing, and access pertinent financial information, allowing you to make informed decisions.

- An increasing number of businesses are outsourcing their accounts payable processes to a specialized third-party team.

- Outsourced accounts payable services are scalable to meet the requirements of your business.

- Sometimes the costs of hiring and training new accounts payable staff exceeds the cost of outsourcing the tasks they would be performing.

- This includes matching invoices to purchase orders, confirming receipt of products or services, and ensuring proper authorization before processing payments.

- Outsourcing companies may not always be transparent in how they deal with your AP processes.

The pandemic further spotlighted the inadequate infrastructure and poor healthcare systems that impact service delivery in many offshore locations.

Our AP automation tools can easily integrate with the systems you already use, so there won’t be any major overhaul to procedures. When you’re outsourcing Accounts Payable, you’re hiring an outside team to fully take over and run your AP department. An Accounts Payable outsourcing company will utilize automation software to maximize efficiency and accuracy. Alternatively, automation technology can be implemented in-house and be operated by your Accounts Payable team.

Reasons Businesses Might Outsource Accounts Payable

But it involves incurring other costs such as investing in the software and allocating time for training the employees to use the software. Over the years, we have built a comprehensive list of accounts payable processing services across industry verticals. Our commitment to accuracy and completeness in managing outsourcing services has helped us grow our business by leaps and bounds. We follow the standard accounts payable process, such as maintaining the master vendor file, receiving and uploading invoices into a financial system, verifying, and approving and processing payments. As a specialized accounts payable outsourcing company, we guarantee you services that will ensure your financial statement and cash position is healthy and transparent.

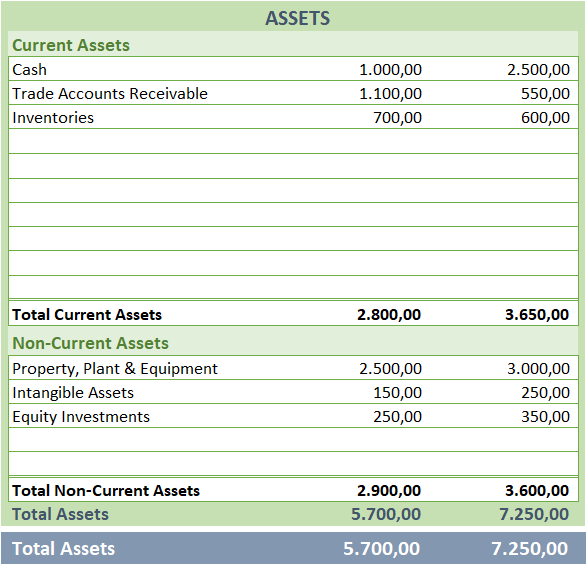

The first step in this process is to receive invoice receipts from suppliers and vendors and process them. It includes ensuring proper authorization and inputting invoice details into the accounting system. Some people mistakenly believe that accounts payable refer to the routine expenses of a company’s core operations, however, that is an incorrect interpretation of the term. Expenses are found on the firm’s income statement, while payables are booked as a liability on the balance sheet. A payable is created any time money is owed by a firm for services rendered or products provided that has not yet been paid for by the firm.

The $500 debit to office supply expense flows through to the income statement at this point, so the company has recorded the purchase transaction even though cash has not been paid out. This is in line with accrual accounting, where expenses are recognized when incurred rather than when cash changes hands. The company then pays the bill, and the accountant enters a $500 credit to the cash account and a debit for $500 to accounts payable.

Accounts payable outsourcing vs accounts payable automation

Whether or not you should consider using accounts payable outsourcing services depends on a number of factors. As the world of enterprise grows increasingly competitive, your company has to constantly strive to finetune its administration, improve its services, and ultimately stand out among competition in order to succeed. Outsourcing accounts payable can be a practical solution for businesses looking to thrive in a fiercely competitive environment, while simultaneously cutting down on costs.

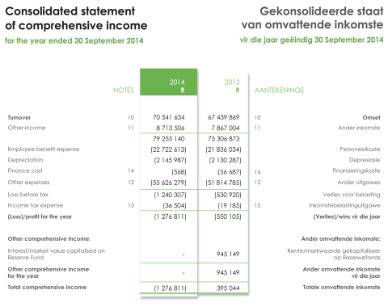

The study also revealed that best-in-class AP departments who relied on procure-to-pay (P2P) automation derived the most strategic value. When complications occur in your accounts payable processes, they can hamper your business growth. AP outsourcing usually involves several changes to your accounts payable processes. If you’re outsourcing accounts payable data, you need to share your confidential financial data with the third-party provider.

Should you outsource your accounts payable?

Free up your resources from time- and effort-intensive paper work and data entry to help them focus on more strategic initiatives. Outsourcing accounts payable isn’t just about handing over a company’s AP tasks and calling it a day. Leading outsourcing providers like Corcentric will elevate the AP process with a combination of industry experts and state-of-the-art technology. And the accounts payable outsourcing service usually has remote access to your accounting software to keep your general ledger and expense reports up to date. To meet their needs, RSM provides outsourcing solutions that cost-effectively improve finance and accounting functions.

Without this communication, even the slightest issue could lead to trouble down the line and a mix-up in accounting books. Understandably, a huge concern would be how much access they have and whether or not they will take the necessary steps to health insurance properly secure your data. To ease these worries it’s important to thoroughly vet any potential partners before signing a contract and make sure that there are explicit terms included stating how they will handle the data entrusted to them.

Data and documentation will be transferred securely, and the outsourcer will manage day-to-day accounts payable responsibilities while providing regular updates and reports. We manage the entirety of the payment procedure, including payment schedules, vendor communication, and payment execution. By optimizing payment cycles and assuring adherence to payment terms, we help you maintain positive relationships with your vendors and maximize early payment discounts. Data privacy and security are two of the major issues that come up with AP outsourcing. After all, when you decide to have someone else handle your AP functions you’re entrusting them with critical information about your business accounts and vendors. Finally, AP outsourcing provides companies with access to advanced technology solutions that would normally be too expensive for them to develop or maintain on their own.

How To Outsource Your Entire Accounts Payable Department or Just Add to Your Accounts Payable Team?

Outsourcing means you don’t have to pay staff salaries, pensions, office space or office equipment. Depending on your situation and how much it costs to outsource accounts payable for your company specifically, you could significantly cut costs through outsourcing. If you identify with any of these motivations, then you’re in the right place. In this post, we’ll go over exactly what is meant by outsourcing accounts payable, as well as outline the pros and cons of outsourcing accounts payable. That way, you can make an informed decision about whether it’s the right option for your business.

Efficient and Streamlined Accounts Payable Solutions with Account Payable Services

They have a lot of AP experience, and they dedicate every resource to that one job. You should also pick partners used to working with similarly sized organizations. With less scale, smaller enterprises need more flexibility from outsourcing partners than multinational corporations. Larger outsourcers are less willing and able to customize solutions because their operations are structured to handle large volumes.

Accounts Payable Services

You can use Personiv’s Outsourcing Cost-Savings Calculator to see real outsourcing rates from us. Book this 30-min live demo to make this the last time that you’ll ever have to manually key in data from invoices or receipts into ERP software. GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Find out how GoCardless can help you with ad hoc payments or recurring payments. To get an idea of the service’s impact on other businesses, look for case studies and customer testimonials. Make sure you check the security policies of your provider to ensure they are compatible with yours.