05 Jul What Is Pips In Forex Trading?

For example, if a share price went from $25 to $30, traders would say it has moved 5 points. It is 1/10 of a pip, usually calculated using the 5th decimal (in JPY pairs, it is calculated using the 3rd decimal). ‘Pips’, ‘spreads’, and ‘pipettes’, are all common forex terms that new aspiring forex traders need to wrap their heads around. In FX markets, the spread would be represented in the difference between these numbers would be the spread, measured in pips.

By knowing what a pip is, you’ll be able to calculate the profit/loss of your trade. The concept of pips is very important in trading in order to understand how exchange rates move, how to calculate the profit or loss on a position, and how to manage risk effectively. However, many traders still lack a deep understanding of pips in trading and risk management, which puts a large burden on their trading performance. In light of this, we’ve provided a detailed guide on what pips are in Forex trading, how to calculate their value, what pipettes are, and much more. When trading in the foreign exchange (forex) market, it’s hard to underestimate the importance of pips.

Pip Values for U.S. Dollar Accounts

Sometimes, the price action won’t reach your anticipated price point. At this time, you must have the discipline to believe in your system and not to second-guess it. Discipline is also the ability to pull the trigger when your system indicates to do so. For example, some traders like to buy support and sell resistance.

We want to clarify that IG International does not have an official Line account at this time. We have not established any official presence on Line messaging platform. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money.

Case 3: USD/JPY – 2 Decimals

Hyperinflation refers to a period where prices of goods and services are increasing excessively and in an out-of-control fashion. When FX movements become extremely high, pips lose their utility. Since most currency pairs are quoted to a maximum of four decimal places, what is a pip in forex trading the smallest whole unit change for these pairs is one pip. Forex traders buy and sell a currency whose value is expressed in relation to another currency. Quotes for these forex pairs appear as bid and ask spreads that are accurate to four decimal places.

How to Trade Forex – Investopedia

How to Trade Forex.

Posted: Wed, 31 May 2023 14:33:04 GMT [source]

Simply put, a pip is synonymous with the term “basis point” (bps). That is, when we define what does pip mean in Forex, we mean exactly such definitions. The “bid” is the price at which you can sell the base currency, whereas the “ask” is the price at which you can buy the base currency. The bid and ask prices can be found inside the MetaTrader 4 trading platform. To see forex spreads in action, check out our live forex rates and watch the difference in spread between standard and pro accounts in real time.

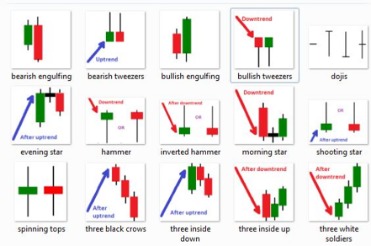

Learning what a pip is in Forex terms is best done through a few examples. In the following lines, we’ll calculate the total value of profits/losses on various currency pairs. For most currency pairs, a pip represents a one digit change in price at the fourth decimal place. Pip stands for ‘point in percentage’ which represents a movement equivalent to one hundredth of 1%. With stock trading, pips are very rarely used as a term to define price movement since the shifts in stock prices move far more aggressively than they do in the foreign exchange market. A pip is the standardised unit measuring a change (both gains and losses) of a currency pair in the forex market.

Why Use Pips

Now that we learned that a Pip is simply a small measurement change in currency prices, we need to understand the logic behind all of this. One of the most important points to remember about this formula is that the result will always be expressed in terms of the base currency (the first one in your pair). In most pairs involving the JPY, a pip equals a movement of 0.01 (second decimal position). Now, you know exactly what is pips in Forex, and this allows you to objectively evaluate the results of each transaction and make correct predictions. Also, the definition of what’s a pip in Forex helps to effectively manage risks and adjust your actions according to the market situation.

Forexlive Americas FX news wrap: US unemployment rate jumps – ForexLive

Forexlive Americas FX news wrap: US unemployment rate jumps.

Posted: Fri, 01 Sep 2023 20:34:00 GMT [source]

For JPY crosses, a movement at the third decimal place represents a pipette. For spread bets, your pip value is determined by the amount of money that you’ve placed for every point of movement in a currency pair’s price – which is how spread bets work anyway. To calculate the value of a pip you must first multiply one pip (0.0001) by the lot or contract size. Standard lots are 100,000 units of the base currency, while mini lots are 10,000 units. Your broker is the most reliable source of information about the trading products they offer. Some brokers offer fractional pips (“pipettes”), so you’ll want to figure out what the smallest movement is that your broker will measure.

Implementing a Forex Trading Strategy

This strategy is traded only at retracement levels because the market direction corrects itself to confirm the trend that gives maximum success in trades. The base value of a trader’s account will determine the pip value of many different currency pairs. For a USD-denominated account, if the currency pair has USD as the second (quote) currency, the pip value will always be $10 on a standard lot, $1 on a mini lot and $0.10 on a micro lot. Using these small units to measure price movement can also protect inexperienced traders from big losses.

This means that for every pip movement in the GBP/USD currency pair, you would make or lose $7.69, depending on the direction of the trade. First, the trader must determine the amount of capital in his account he is willing https://g-markets.net/ to risk per trade. This means that the trader can make 100 trades before his capital is wiped out. If the trader’s account has a balance of $5,000 and he is willing to risk 1% per trade, this equates to $50 per trade.

Calculating the Pip Value for Different Forex Pairs

On the other hand, when the USD is the first of the pair (or the base currency), such as with the USD/CAD pair, the pip value also involves the exchange rate. Divide the size of a pip by the exchange rate and then multiply by the trade value. Although there is no such thing as a “safe” trading time frame, a short-term mindset may involve smaller risks if the trader exercises discipline in picking trades. Here’s how to figure out the pip value for pairs that don’t include your account currency. For example, if you have a Canadian dollar (CAD) account, any pair that is XXX/CAD, such as the USD/CAD will have a fixed pip value. A standard lot is CAD$10, a mini lot is CAD$1, and a micro lot is CAD$0.10.

- Profitability or loss of a few pips is expressed in very real amounts in the investor’s accounts.

- The 5-minute time frame is the best suited in this strategy as it provides clear reversal points in the market when needed.

- The two primary reasons for changing pip value include the non-involvement of USD as a currency exchange rate or USD as the base currency.

- As a result, you should carry out both technical and fundamental analysis on the currency pair you want to trade before you open a position.

A spread is defined as the difference between the bid and ask price of a currency pair. In the USD/JPY currency pair, pip movement from 10.44 to 10.43 is a decrease of 1 pip. A strong example was recorded in Zimbabwe in the year 2008, where monthly inflation rates exceeded 79 billion percent in the month of November. When hyperinflation occurs, units of currency increase at an extraordinary rate which makes the small measurement of pips useless. Pips, which are used in forex trading, should not be confused with bps (basis points) used in interest rates markets that represent 1/100th of 1% (i.e., 0.01%). A point is the largest price change of the three measurements and only refers to changes on the left side of the decimal, while the other two include fractional changes on the right.

Finally, knowing the Stop Loss of a trade setup helps in determining the perfect position size for that trade in order to stay inside your risk per trade boundaries. Pipettes are a fractional value of a pip, and have a value of 1/10 of a regular pip. Many brokers use trading platforms with 5 decimal places instead of 4, making it important to understand the meaning of pips in Forex trading and how they differ from pipettes.